Loan Service Solutions: Your Path to Financial Liberty

Loan Service Solutions: Your Path to Financial Liberty

Blog Article

Find the Perfect Finance Solutions to Meet Your Economic Goals

In today's complex economic landscape, the mission to find the excellent finance services that straighten with your special financial objectives can be a complicated task. With countless choices available, it is vital to navigate via this maze with a critical method that guarantees you make notified choices (Loan Service). From recognizing your monetary demands to assessing lending institution credibility, each action in this process calls for careful factor to consider to secure the most effective feasible outcome. By adhering to a methodical technique and considering all elements at play, you can place on your own for monetary success.

Evaluating Your Financial Requirements

When taking into consideration loan solutions for your monetary goals, the first step is to extensively examine your existing monetary needs. Begin by reviewing the particular purpose for which you require the financing.

Moreover, it is necessary to perform a thorough evaluation of your present financial scenario. Take into consideration aspects such as your credit history rating, existing financial obligations, and any upcoming expenditures that might impact your capacity to pay off the funding.

Along with understanding your economic demands, it is suggested to research study and compare the financing choices available in the market. Various financings included differing terms, rate of interest prices, and settlement routines. By carefully examining your requirements, economic position, and readily available lending products, you can make an enlightened decision that sustains your financial goals.

Understanding Finance Options

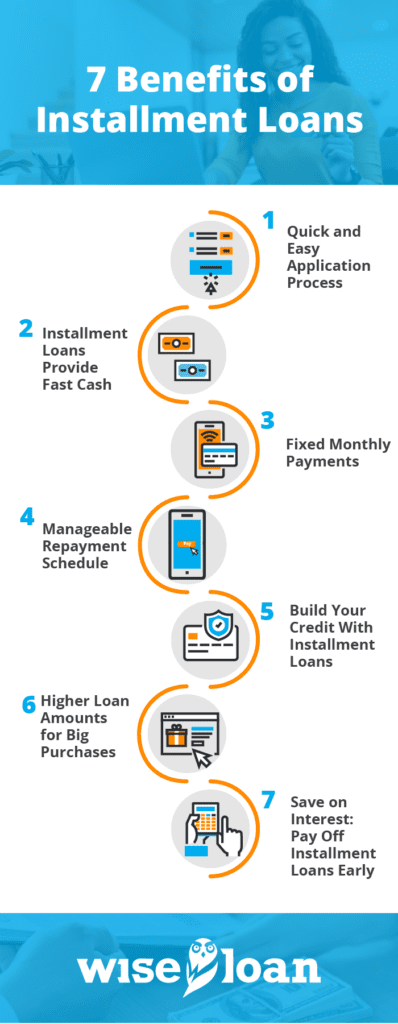

Checking out the array of funding alternatives available in the monetary market is crucial for making notified choices straightened with your specific requirements and objectives. Recognizing car loan choices entails familiarizing yourself with the different kinds of loans provided by banks. These can vary from traditional options like personal fundings, home mortgages, and vehicle lendings to much more specific items such as home equity finances, cash advance loans, and student car loans.

Each type of finance features its very own terms, problems, and payment frameworks (mca loan companies). Personal loans, for example, are unsecured finances that can be used for different objectives, while home loans are safeguarded car loans especially developed for acquiring property. Car loans satisfy funding vehicle purchases, and home equity finances allow house owners to obtain against the equity in their homes

Comparing Rate Of Interest Prices and Terms

To make informed decisions relating to lending choices, a critical step is comparing rates of interest and terms supplied by banks. Rates of interest establish the expense of obtaining cash, impacting the total amount paid back over the funding term. Reduced passion prices mean lower overall costs, making it vital to seek the finest prices offered. Terms describe the problems of the finance, consisting of the settlement duration, costs, and any kind of added needs established by the lending institution. Recognizing and contrasting these terms can assist debtors select one of the most appropriate funding for their monetary circumstance. When comparing interest rates, consider whether they are dealt with or variable. Dealt with prices stay continuous throughout the car loan term, offering predictability in repayment quantities. Variable prices, on the other hand, can vary based on market problems, potentially affecting monthly settlements. Furthermore, evaluate the impact of loan terms on your economic goals, ensuring that the picked finance lines up with your budget and lasting goals. By thoroughly evaluating rate of interest and terms, borrowers can choose a funding that best fulfills their requirements while minimizing expenses and risks.

Evaluating Loan Provider Online Reputation

In addition, think about consulting governing bodies or monetary authorities to guarantee the lender is qualified and certified with industry laws. A credible lender will certainly have a solid track record of honest financing techniques and transparent communication with debtors. It is also valuable to look for recommendations from pals, household, or financial consultants who might have experience with trusted lending institutions.

Eventually, picking a loan provider with a solid credibility can offer you assurance and self-confidence in your borrowing decision (merchant cash advance providers). By conducting comprehensive research and due diligence, you can select a lending institution that straightens with your economic objectives and values, setting you up for an effective loaning experience

Choosing the Finest Funding for You

Having extensively assessed a lending institution's credibility, the following crucial action is to meticulously choose the ideal lending choice that straightens with your financial goals and demands. When choosing a car loan, take into consideration the purpose of the funding.

Contrast the rate of interest prices, financing terms, and charges offered by different loan providers. Reduced interest rates can save you cash over the life of the financing, while beneficial terms can make payment a lot more convenient. Consider any extra expenses like source costs, early repayment fines, or insurance requirements.

Select a funding with regular monthly repayments that fit your click here to read budget and duration for settlement. Eventually, select a lending that not just fulfills your present financial needs yet likewise supports your lasting monetary goals.

Verdict

In verdict, discovering the perfect loan solutions to satisfy your financial objectives requires a thorough analysis of your monetary demands, comprehending car loan options, contrasting rates of interest and terms, and assessing click site lending institution track record. By thoroughly thinking about these factors, you can select the very best car loan for your certain situation. It is important to prioritize your monetary purposes and select a financing that lines up with your long-lasting financial objectives.

Report this page